16 Most Popular Traded Currency Pairs

Contents

Stable economies like the US or Japan tend to attract a large amount of foreign investment, which helps increase the value of their currencies. Whereas less stable economies receive less investment, which leads to a weaker currency. The quotation of two different currencies being traded, by which the value of one is compared to the value of the other, is called a ‘currency pair’. According to its literal meaning, a safe haven is “a place where somebody can go to be safe from danger or attack.” In the Forex world, this term refers to currencies that traders refer to in times of financial instability.

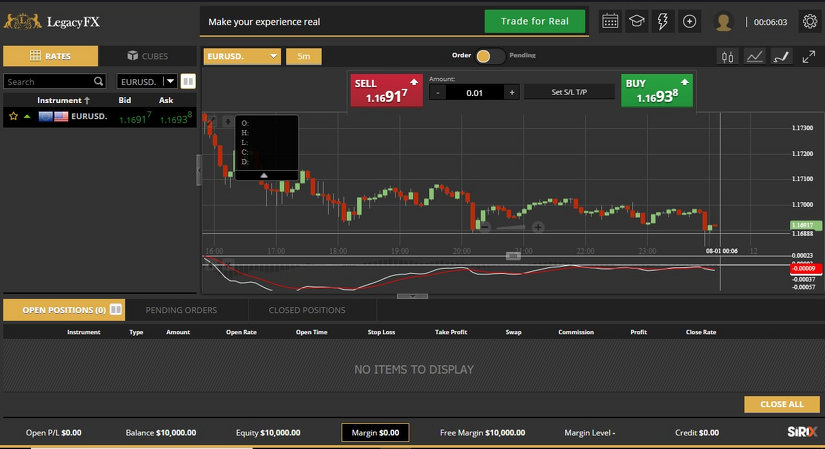

The currency code indicates how much quote currency is required to purchase the base currency. The first price listed is the bid price, and the other is the ask price. When buying a currency pair, a person buys one currency in exchange for another. The difference between the bid and ask price is called a spread indicated by pips. Currency pairs are written as a forex quote consisting of two separate currencies. The first in the forex currency pair is always the base currency, whereas the second currency is the quote currency.

Fundamental analysis involves analyzing a country’s economic data and upcoming catalysts that could change lead to price changes. Therefore, a person should look at strong fundamentals as a positive factor in the value of a currency. Exotic pairs will be less liquid, and spreads can be significantly wider. A currency pair is a combination of two currencies their values compared against each other.

For example, if American interest rates are low, USD would probably weaken against AUD and it would cost more US dollars to buy one Australian dollar. Forex is the largest and most volatile market in the world with hundreds of currency combinations to choose from. To simplify things, here are the ten most traded forex pairs on the market. Majors have the highest liquidity of the four types of currency pairs; but, since these currencies are usually easier to evaluate, trading majors can be crowded and competitive. Since traders from all over the world exchange currencies on the market, having 24 hours allows individuals to participate despite time zone differences.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Discover the range of markets you can spread bet on – and learn how they work – with IG Academy’s online course. Economic growth in South Korea has been so impressive – especially since the end of the Korean war in 1953 – that people often refer to it as the Miracle on the Han River. FX Central Clearing Ltd (/eu) provides services to the residents of countries from the European Economic Area only.

Both currencies will have exchange rates on which the trade will have its position basis. All trading within the forex market, whether selling, buying, or trading, will take place through currency pairs. Hundreds of currencies are traded across the foreign exchange market in a complex array of combinations; however, research suggests that around 85% of all forex activity is conducted using just seven distinct currency pairs. These are known collectively as the ‘majors’, and all involve the USD dollar — the primary global reserve currency and the most widely used currency internationally — as one half of the pair. Major Pairs– Major pairs are global currencies typically paired against the USD, and make up more than 80% of international forex trading. Minor pairs, also known as cross-currency pairs, don’t contain the US dollar, but still include widely traded currencies like the euro, British pound, and Japanese yen.

Just because someone makes a good living off one pair does not mean the pair would fit into your strategy. Interest rates set by the Bank of England and the European Central Bank are also important to watch for EUR/GBP. The price of EUR/GBP has been extremely volatile in the run-up to the UK’s exit from the EU. Because of the geographical location and good trading ties between Europe and the United Kingdom, this is a challenging pair to forecast. This trading pair is also known as trading the “loonie.” This pair has a negative correlation with the AUD/USD, GBP/USD, and EUR/USD. GBP/USD is popularly known as the “cable.” The pair has a negative correlation with the USD/CHF but a positive correlation with the EUR/USD.

This currency pair is more volatile than “The Fiber” or “The Gopher”, due to the frequent price fluctuations it experiences. This volatility is preferred amongst certain traders as it creates the opportunity to create larger returns. Any Information or advice contained on this website is general in nature and has been prepared without taking into account your objectives, financial situation or needs.

Due to the overall lower degree of liquidity, exotic currency pairs tend to be far more sensitive to economic and geopolitical events. In forex, it’s based on the number of active traders buying and selling a specific currency pair and the volume being traded. While there are EIGHT major currencies, there are only SEVEN major currency pairs.

In addition, more than 20 countries outside the Eurozone have pegged their currencies to the Euro in order to stabilise their exchange rates, such as Bulgaria, Bosnia, and about 15 African countries. The Euro is the 2nd most traded currency, and the 2nd largest reserve currency. Japanese yen – Historically, the Japanese yen has proved on multiple occasions its ability to rise from the ashes of market volatility and uncertainty. For example, during financial turmoil like the financial crisis of 2008, while many currencies were depreciating, the Japanese yen rose by almost 20%. However, despite its safe-haven status, the yen has at times experienced depreciation. The Swiss Franc is also known in the currency trading world as the Swissie and the currency code, CHF comes from the old Latin name for Switzerland, Confoederatio Helvetica with the F standing for Franc.

When buying a currency pair, they buy one currency in exchange for another one. The foreign exchange market is centred around the practice of buying quantities of different global currencies with a view to making a profit through the disparity in relative value between them. The primary difference is that when trading commodities you are speculating on the price moves of physical items such as gold, wheat, cocoa, crude oil and others. Currency trading is speculating on the relative value of one country’s currency versus another.

What are the Majors?

However, in recent years, the US dollar’s safe-haven status has been questioned, especially during 2020’s Coronavirus pandemic, where it fluctuated. Furthermore, there are a total of 8 major currency pairs; all of them involve the US Dollar. If the US dollar is not one of the currencies in the pair, it is not considered a major currency pair. In fact, EURUSD is the most traded currency pair in the world that takes about 30% of the total multi-billion dollar Forex turnover. And it is not surprising since the economies of the US and the European Union are the largest ones. Being one of the world’s most liquid markets, Forex involves various currency pairs.

The reason that they are called exotic currency pairs has nothing to do with the location of the country, but rather the additional challenges involved in trading these currency pairs. Exotic currency pairs are generally illiquid, with wider spreads and fewer market-makers. Examples of exotic currency pairs include the South African Rand , the Hong Kong Dollar and the Mexican Peso . In light of this, this article will reveal what currency pairs are, and take you through the most traded currency pairs in the forex market today. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

USD/CHF is a popular currency pair because the Swiss financial system has historically been a safe haven for investors and their capital. Keep in mind that increased volume contributes to increased liquidity and market stability. This does not necessarily imply eur usd that these are the best pairs to trade. Scalpers tend to trade the most common currency pairs, with EUR/USD, USD/CHF, GBP/USD, and USD/JPY being their top picks. A currency pair is the listing of two different currencies, their values quoted against each other.

May 2022 Market Wrap

Affectionately nicknamed after the flightless bird famously endemic to New Zealand that’s pictured on its $1 coin, the New Zealand dollar was introduced as the country’s official currency in 1967 to replace the British pound. Originally pegged to its historical predecessor, GBP, the NZD is now considered a free-flowing currency, mainly affected by New Zealand’s agriculture and tourism data releases. The Swiss Confederation is also notable for being a close trading partner with its European neighbours without formally being part of the eurozone itself. As a result, the Swissie pair has always displayed a near-perfect negative correlation with EUR/USD, meaning that one rises as the other falls and vice versa — it also has a similar negative correlation with gold. Despite its comparatively small landmass, International Monetary Fund statistics have indicated that the UK has the fifth largest GDP of any country worldwide. Its economy is also closely linked to that of the neighbouring EU, which is why the GBP/USD pair has many behavioural similarities with the Euro.

Which currency pair is the least volatile?

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

For instance, a change in a country’s interest rate can impact the appreciation or depreciation of a currency pair. When a central bank raises interest rates, it can increase the value of a country’s currency, whereas lower interest rates can decrease the value of a country’s currency. Within a pair, there are two parts – the base currency and the quote currency. The base is the first currency in a pair, and it’s the currency the trader believes will rise or fall against the quote currency. For example, if you were to sell Japanese yen versus US dollar (JPY/USD), it means that you anticipate that the price of the Japanese yen will fall against the USD dollar. US dollar – the greenback has always been a safe-haven currency for traders as it is the reserve currency of the world’s largest economy and has the most market liquidity.

Most Traded Currency Pairs

Today, with all areas having access to technology, the industry has seen exponential growth. People from rich countries like the United States and those from poor countries like Zimbabwe are participating in this trade. Another significant pair, this one is made up of the Australian dollar and the US dollar. The value of commodities exported by Australia, such as iron ore, gold, and coal, as well as interest rates set by the Reserve Bank of Australia and the US Federal Reserve, influence this pair. Compared to the crosses and exotics, price moves more frequently with the majors, which provides more trading opportunities.

For example, due to the size and strength of the United States economy, the American dollar is the world’s most actively traded currency. The US dollar and Swiss franc currency combination, popularly known as trading the “Swissie”, may appear to be an unexpected inclusion given Switzerland’s small global economy. However, this currency combination is popular because to Switzerland’s strong image. Despite being less liquid than the other major pairs listed, it remains a popular choice among traders. Political events can have a considerable bearing on the strength of currencies – Great Britain’s exit from the EU is an excellent example of this.

Currency trading

The larger the volume the higher the liquidity as more traders are buying and selling these currencies. Both the relatively lower volatility and the popularity of its trade are reflective of the fact that the European Union and the United States represent the two largest economies in the world. Of course, the EUR/USD is not immune to volatility though and still subject to price shocks. The forex major currency pairs are a series of currencies that are commonly traded. Due to the fact that these pairs are popularly and often traded, the price bands tend to be narrower but–like all currencies–they’re still subject to the volatility of the market. So, the British pound, the Japanese yen, the Swiss franc, the Australian, and the Canadian dollars will make up the most actively traded currency pairs together with the US dollar and the Euro.

Remember that the forex market can be volatile and trading with leverage can greatly increase the chance of losses for traders. Therefore, we advise you to consult our risk management section and familiarise yourself with stop-loss measures as part of an effective trading strategy. is open 24 hours a day, from Sunday evening until Friday night, which takes advantage of the international time zone differences of London, Tokyo and New York.

Trading in Forex, which is short for Foreign Exchange, has surged in popularity in the 21st century amongst individual retail traders, who trade on both a professional and non-professional basis. Although FX trading has been an important part of the larger banking system for centuries, this area has long been inaccessible to the individual. USD/CHF. This currency pair sets the US dollar against the Switzerland robinhood penny stocks currency. USD/GBP. This currency pair sets the US dollar against the United Kingdom pound and is commonly referred to as the pound-dollar. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

It essentially defines monetary policy, regulates and issues money, with its head office located in Frankfurt . Following the ISO4217 standard, currencies appear as three-letter codes, which tend to be formed from two letters that stand for the region, and one that stands for the currency itself. For instance, USD stands for the United States dollar and JPY for the Japanese yen. Each currency pair has a ‘base’ which is the first denoted currency, and a ‘counter’ which is the second denoted currency.

Plan your trading

The British Pound the oldest currency globally that is still in circulation. It is also the third most popular reserve currency , plus the fourth most traded currency. With the UK leaving the EU after Brexit in 2020, the Pound is unlikely to adopt the Euro any time soon.

Which forex pairs are most profitable?

EUR/USD. The Euro/US dollar pair is regarded as the most profitable currency pair in forex for the following reasons; High Liquidity: The European economy is the second-largest globally, while the US is the largest.

Exchange rates fluctuate based on which currency is stronger at the moment. Imagine each currency pair constantly in a “tug of war” with each currency on its own side of the rope. The information on this website (“Information”) is strictly not intended for any person in any jurisdiction where it is unlawful to access or use such information.

It is the world’s largest and most liquid currency pairs in financial market. EUR/USD is the most popular currency pair on the forex market featuring the two largest currencies, with transactions making up approximately 24% of daily forex trades. If you want to test your trading strategy with popular Forex pairs, try our free demo account which includes live market quotes and a range of Forex trading indicators. You’ll be able to view in real-time how the currency pairs perform and familiarise yourself with the trading tools and terminology.

Major Forex Currency Pairs: A summary

With a stable financial system and government, traders turn to the franc in times of economic uncertainty. Although it is less liquid than the other major pairs listed, it’s still a popular choice among traders. The foreign exchange market is the largest and most liquid market in the world. It offers exchanges between any two nation’s currencies and includes major, minor and exotic currencies. The result is a market that offers hundreds of possible currency pairs to trade.

While they are considered safe-haven currencies it should be noted that even safe-havens have the tendency to depreciate at times, and so traders should not completely rely on them. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. These pairs have shown the minimum trading volume at the time of this writing. It is often argued that the top traded pairs are also the most predictable ones.

You can trade nearly 100 currency pairs with easyMarkets, including major, minor and exotic pairs. Known as “The Gopher”, this currency pair is one of the most popular pairs amongst traders. This means that traders can buy and sell the currency pair without experiencing significant fluctuations in the exchange rate. The US Dollar, Euro, Yen and the other popular currencies combine as pairs to make the Majors, as described earlier in the guide. 77% of retail investor accounts lose money when trading CFDs with this provider.

Authorised and regulated by Cyprus Securities and Exchange Commission in the Republic of Cyprus at 19 Diagorou Str. Deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Another condition offered as a standard feature on easyMarkets accounts, this ensures you are protected when you trade.

The first currency in the pair is called the base currency, the value of which is quoted against the second currency or quote currency. The U.S. Dollar is by far the most heavily traded currency being on 88 percent of all trades trade99 review in 2019. Dollar by being on 32 percent of transactions, and the Japanese Yen is on 17 percent. When purchasing stock, a person exchanges a currency, such as the U.S Dollar, for either a share of a business or a commodity.