Track Billable Hours by Customer in QuickBooks Online, Desktop, & Pro

Contents:

When expanded it provides a list of search options that will switch the search inputs to match the current selection. TSheets and Harvest are two robust tools for tracking time. Harvest offers a free version of the software with a 30-day free trial. The paid plan starts at $12/seat per month for unlimited users. Integrations make it easy to unify existing and new systems and improve project management.

You can press the “Yes” button if you want to allow it. Doing so, the hours will be added automatically to the payroll timesheet of an employee. You can repeat the same procedure for other employees if required.

Enter the Time in QuickBooks Pro

Later, you can view the billable hours every time you bill your customers. As you follow these steps and save details, the weekly timesheet will help you to track the hours of your customer in QuickBooks Online. If you’re looking for other accounting software with time-tracking features, several QuickBooks alternatives, such as Zoho Books, may work for you. Read our Zoho Books review for more information. If you are unable to find a report to meet your needs, contact QuickBooks, and a rep can help you adjust one for the information you want.

- The tool also has Stripe and PayPal integrations, which means that your clients can immediately pay your invoices.

- If you use QuickBooks Online for accounting, it’s easy to track time and enter billable hours.

- TSheets provides easy invoicing with its Xero, Gusto, and QuickBooks Online integration.

- Alternatively, you can use the down arrow located next to the “Enter Time” option on the home page.

- When a new window opens, mention the “Date Range” option.

A CPA may sell hours of consulting, accounting, or tax preparation work. Check the Add Service field to timesheets or Add Customer field to timesheets. When either of these are checked, employees and contractors who fill out time sheets can specify if activities should be billed to a customer. With Time Tracking, you can track time worked by your employees and contractors. You can easily assign a particular activity to a project or customer, and choose whether to bill your customers for the activity. To reduce the risk of under-billing, use the Timely integration for Quickbooks.

This report shows a full list of the billable time you haven’t billed/invoiced for yet. All the information I previously provided is automatically entered into the invoice. This includes the notes I put in the Description field. All of these fields can be edited before sending your invoice. In this example I’ll be billing Customer A. On the right-hand side of the screen you can see a list of all the billable times I’ve worked for Customer A that haven’t been invoiced yet. The “Cost rate (/hr)” is for you to keep track of how much it costs you for the work being done.

If you need accounting, payroll, and time tracking all in one system, it’s an easy suite of products to use together to run your business. Learn more how to integrate QuickBooks Online and QuickBooks Payroll with QuickBooks Time. The system even allows you to indicate the rate multiplier (e.g., 1.5 x rate of pay) and overtime rate such as a fixed amount (e.g., pay + $3 per hour). We’ve compared TSheets and Harvest time tracking software based on project tracking, timesheet reporting, and various other features.

Harvest vs Toggl: A detailed comparison

Time tracking gives you reliable information, including the employee’s start time and a project’s details and scope. With QuickBooks, employees can log their time on a task from anywhere with internet access. You can provide entry-only access, so they see only the information they need. You can also select clients for billable tasks and add users as needed.

Check off “Billable (/hr)” and enter an amount for what you are billing the customer. Apps.com is a list of applications that integrate with QuickBooks. There are many apps and solutions to help you track when your… QuickBooks has powerful features to help business owners manage… Under First day of the workweek, select Monday.

Uncheck that option and select “Edit” to choose team members or a specific group. Choose the delivery method on how you want the system to send the invitation to track time using QuickBooks Time. The invitation will guide the team member through setting up their own account. QuickBooks Time lets you create custom permissions for employees, but it won’t allow you to select the “account management” field, as it is limited to administrators only.

Access data quickly

Creating and managing schedules in QuickBooks Time is easy. Click “Save” or hit “Enter” on the keyboard to start the next job. Click “Set up Time Off” and look for the time-off type/code you want the system to track. Payroll hours of synced members will be automatically sent to QuickBooks Online every 24 hours. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

QuickBooks Online Pricing: Costs & Plan Comparison 2023 – Tech.co

QuickBooks Online Pricing: Costs & Plan Comparison 2023.

Posted: Fri, 24 Feb 2023 08:00:00 GMT [source]

You should also contact the office if the service you are defining is used in assemblies or is performed by a subcontractor or partner, as these are more advanced situations. Learn how to record and asset purchased with a loan in QuickBooks Online. This is more complicated than I’d want to put into a blog. If you’d like to set up an appt with me (/meeting), I’d be happy to discuss this with you.

Although both tools offer a 30-day free trial, Harvest is a more affordable time tracking software than TSheets. You can view and export these reports with or without data from other sections of the tool to improve project management and gain better insights into your team’s performance. Employees can use the QuickBooks Time mobile app to clock in and out, track Paid Time Off and sick days, add notes, and even attach images to their timesheet.

Best Accounting Software for Freelancers and Self-Employed of … – NerdWallet

Best Accounting Software for Freelancers and Self-Employed of ….

Posted: Wed, 15 Mar 2023 07:00:00 GMT [source]

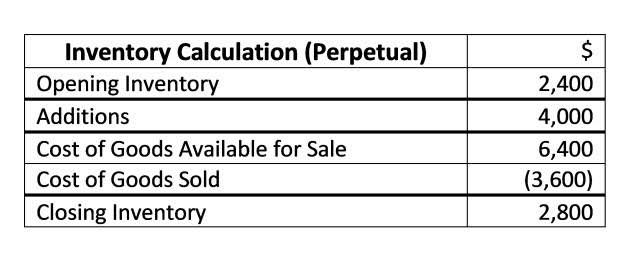

It goes away, and your inventory count in QuickBooks is reduced by one. This tracking helps you know what is selling and what is not, and it signals when a reorder is due. Time is where you enter how much time was spent doing the work.

TSheets vs Harvest: Final verdict

As you allow your debits and credits to track the hours of a customer, it starts tracking the time depending on the day you have selected. The time tracking feature makes it possible for you to track the customer’s hours in QuickBooks Online. All you have to do is enable the Time Tracking feature in your account and set the necessary preferences. Time-tracking was a way to track job time for purposes of billing hours. QuickBooks Pro Timer was the first time-tracking app .

You’ll first need to enable this function to create records for billable time and track hours spent. QuickBooks makes it easy to track employees’ hours across different products, services and customers to generate accurate bills. You can use these time-tracking functions to compensate employees correctly while monitoring the organization’s overall productivity. QuickBooks has time-tracking features to help you track billable hours and invoice clients accurately.

- They may even allow you to clock in to track class, location and project, depending on which accounting solution you are going to sync with.

- In the Date field, add the number of hours the employee worked for the customer.

- All exchanged messages stay forever saved and accessible.

- Once time tracking is set up you may access the time sheets by going to Employee and selecting Single Activity Time Sheet or Weekly Time Sheet.

- The paid plan starts at $12/seat per month for unlimited users.

You should be able to select this person’s name from the Name drop-down list. If you can’t choose the person’s name from the Name drop-down list, enter it in the box; then, when prompted, tell QuickBooks to which list the name should be added. QuickBooks supplies two methods for tracking the time spent that will be billed in an invoice as an item. You can use the weekly time sheet, or you can time or record individual activities. I briefly describe how both time-tracking methods work; neither is difficult. Integrating time tracking with your accounting software can save you time and money by streamlining the process of entering employee hours, invoicing clients, and tracking project costs.

QuickBooks helps you to meet all the requirements that a business may require. Using the Time Reports and Invoicing, you can easily track billable hours in QuickBooks Desktop. In the middle column, select the correct Payroll Item from the drop-down list.